how much tax is taken out of my first paycheck

522 Is pension included in personal income. These are the same program.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

It has the same due date as a W-2 which is on April 15th unless it falls on a weekendIn that case they are due on the first business day after.

. Adjust your W-4 withholdings to get a bigger tax refund or a bigger paycheck. Tax Guides. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

If you get confused when completing your W-4 the IRS provides a free withholding calculator to help you determine the amount of money that should be taken out of your paycheck for income tax. Getting your refund status via your IRS Tax Transcript. A W-4 tells your employer how much tax to withhold from your paycheck.

53 Do I have to pay income tax on my pension. Refund the excess withholding to the employee. Paycheck Protection Program Guide.

And if you take out a significant amount it could bump you into a higher tax bracket. You dont actually have to do anything. 521 Does pension count as annual income.

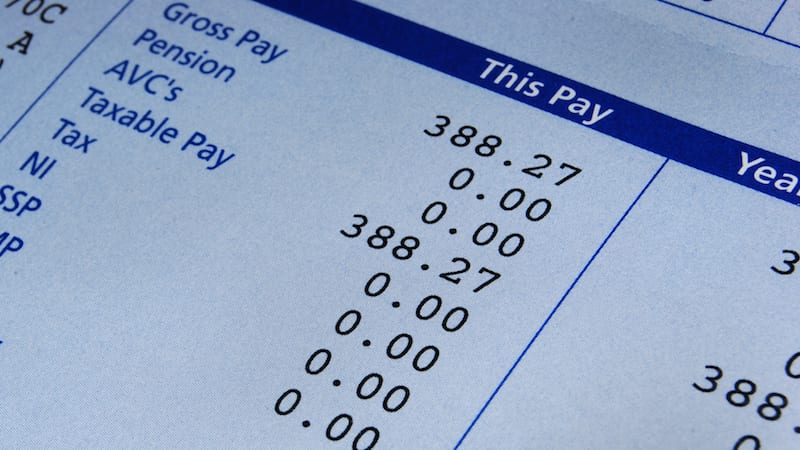

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. The money that is taken out is matched by your employer and paid into. Withholding tax is income tax withheld from employees wages and paid directly to the government by the employer and the amount withheld is a credit against the income taxes the employee must pay.

532 How can I avoid paying tax on my pension. When you get your first paycheck you may be surprised at the different paycheck deductions. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA.

There are a couple of scenarios you may find yourself in when starting a new job including. With each paycheck youll see money taken out for taxes. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major change.

531 Which pension is exempt from income tax. The state taxable wages column shows the amount that your state will tax you on. The more their income will be taxed as a percentage.

This can be done by taking out less from the employees paycheck to offset the excess withholding. Effective Social Security tax rate just 29. Here are the options.

When you are paid once a month it can make budgeting both much easier and much more difficult. Our free W4 calculator allows you to enter your tax information and adjust your paycheck withholding to increase your refund or take-home pay on each paycheck by show you how to fill out your 2020 W 4 Form. While using the official IRS Where is My Refund tool Get My Payment tool or Child tax credit portal is the best way to get the status of your official government payments it only provides limited information around current processing and paymentsOn the other hand your IRS tax transcript which can take a.

What a married couple with two young kids might pay in income tax. Find payroll and retirement calculators plus tax and compliance resources. This is what a W-4 form looks like.

Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. If youd like to calculate the overall percentage of tax deducted from your paycheck first add up the dollar amounts of each tax withheld. The TCJA eliminated the personal.

The Withholding Form. With a 401k your money is taken from your paycheck and invested automatically which means you dont have to go into a brokerage account to invest each month. However they are not typically considered pretax so theyre taken out of your paycheck based on the amount you make before the money is taxed.

Your 401k contribution is deducted from your paycheck the same way that your federal income tax or health insurance premium is deducted. Divide that by the number of paychecks you get in a year. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

How Many Allowances Can I Claim. The withholding column shows the amount that the state withheld. The timing of your first paycheck depends on the payroll schedule that your employer already has in place and your first day of employment.

Once you know your desired amount. That way you wont have to set aside money from each paycheck to cover your rent or mortgage student loan payments or other bills. The percentage can vary based on a variety of factors and it gets even more complicated now that the income tax brackets have changed.

Diversity Equity Inclusion Toolkit. So if you took 20000 from your 401k and that puts you in the 22 tax bracket you may only get about 1200013000 depending on state income tax when all is said and done. Attend webinars or find out where and when we can connect at in-person.

For example lets say your employer-sponsored health insurance costs 250 each month and you earn 4500 each month. To figure out how much you should add first think about how much of a refund youd like to see after doing your taxes. When you are paid once a month you can set up all your bills to be taken out right after you get paid.

Next youll want to adjust line 4c called Extra withholding which adds additional withholding to each paycheck you receive. When should I expect my first check. The First Week Month and 90 Days.

Next lets take a look at a married couple with two kids who have a combined household income of 100000. What If An Employer Withholds Too Much Fica Tax From An Employees Pay. If you over-withhold FICA from an employees pay you should take steps to correct the problem.

How to Succeed in Your New Job. Make sure to prepare your taxes ahead of time as we know doing your taxes can take a while depending on the complexity. Self-employed individuals If you are self-employed you are responsible for paying both the employers and.

512 How much tax do I pay on my pension. That 250 would be pulled for your insurance payment and youd pay taxes. Maximize your refund with TaxActs Refund Booster.

Use our W-4 calculator and see how to fill out a 2022 Form W-4 to change withholdings. 52 Is a retirement pension considered income. But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit.

Understanding Your Paycheck Credit Com

Pay Stub Meaning What To Include On An Employee Pay Stub

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

The Real Numbers In Your Paycheck Southpoint Financial Credit Union

Paycheck Calculator Online For Per Pay Period Create W 4

6 Reasons Your Paycheck Is Smaller Than Expected Cleverism

How To Understand Your Paycheck Youtube

Paycheck Taxes Federal State Local Withholding H R Block

Is Federal Tax Not Withheld If A Paycheck Is Too Small Quora

Understanding Your Teacher Paycheck We Are Teachers

Different Types Of Payroll Deductions Gusto

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Themint Org Tips For Teens Decoding Your Paycheck

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

7 Conversations To Have Once Your Teen Starts Earning A Paycheck

Irs New Tax Withholding Tables

Do You Know What S Being Deducted From Your Paycheck Gobankingrates